Transfer 77,000 points to Flying Blue (the loyalty program of Air France and KLM) for three round-trip economy promo awards between Miami and Paris on Air France.That’s a $4,000+ hotel stay (a value of 5 cents per point). Transfer 80,000 points to Hyatt for a weekend at Alila Ventana Big Sur, an five-star all-inclusive resort.

Here are a few things you can accomplish with the card_name welcome bonus: Once you’ve done that, you can convert your points into airline miles and hotel points. To transfer the rewards you earn from the card_name, you must first move your points onto one of these cards (this can easily be done online).

The caveat is that you can’t transfer your points to airline and hotel partners unless you also hold either the card_name, card_name or card_name. Using your points for travel is far and away the best option to squeeze value from Chase points.

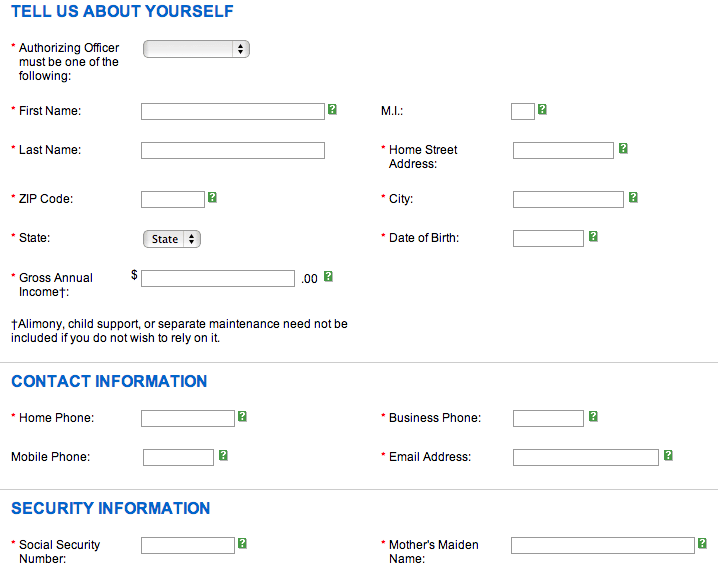

Chase dom card credit requirements free#

Free travel through Chase transfer partners.To pay for your Amazon cart at a rate of 0.8 cents each.Gift cards at a rate of 1 cent each (sometimes 1.1 cents each during promotions).The card_name earns Chase Ultimate Rewards points - not cash back. If your business spending can be channeled through office supply stores (which may include things like Visa gift cards that can be used anywhere), you’ll be sitting on a heap of rewards before you know it. 1% cash back (1 Chase point per dollar) on all other eligible purchases.Ī sizable return like this for common expenses is a big deal, particularly for a no annual fee credit card.2% cash back (2 Chase points per dollar) on the first $25,000 of combined spending at restaurants and gas stations each cardmember year (then 1%).5% cash back (5 Chase points per dollar) on the first $25,000 of combined spending on internet, cable, phone services and at office supply stores each cardmember year (then 1%).5% cash back (5 Chase points per dollar) on Lyft rides through March 2025.The card also earns rewards at the following rate: As you’ll see, the card’s rewards can be converted into airline miles and hotel points which can make nearly free travel possible. This card is also great for those interested in travel.

While it’s got a decent selection of perks, it can’t compete with the ongoing benefits offered by annual fee-incurring credit cards, some of which offer many hundreds of dollars in memberships and statement credits each year. With annual_fees annual fee, the card_name is a good pick if you’re unwilling to make an initial investment for big value. If you’re making money from a similar initiative, you are a small business owner. However, even side-gigs like selling items on Etsy, driving for Uber or various freelance work can be enough to qualify as a business. That means you’ll need to operate a small business to qualify. The card_name is a small business credit card. The card may not be the best for big spenders, though, as its bonus categories have a yearly cap. The fact that the card charges a annual_fees annual fee makes it all the more impressive. Its spending bonuses are generous, and its massive $750 welcome bonus after meeting minimum spending requirements should be reason enough to at least try the card out for a year or two. The card_name is among the most powerful earners in the rewards credit card market. Here’s what you need to know about this card. If you’re on the prowl for a small business credit card, the card_name could be just what you need. That leaves most other annual_fees annual fee credit card bonuses in the dust.įinally, the card earns between 2% and 5% cash back on common expenses, which is well above average. It its welcome bonus will make you bonus_miles_full. at a rate much more favorable than cash back.

Chase dom card credit requirements for free#

It earns Chase Ultimate Rewards® points which can be redeemed for cash, but you can also redeem them for free hotel stays, airfare, rental cars etc. First, though it’s advertised by Chase as a cash back credit card, it’s actually not.

0 kommentar(er)

0 kommentar(er)